By PETER BAKER, ALAN COWELL and JAMES KANTER

An oil production platform at the Sakhalin-I field in Russia partly owned by Russian Oil Company - Rosneft

WASHINGTON — The United States and Europe kicked off a joint effort on Tuesday intended to curb Russia’s long-term ability to develop new oil resources, taking aim at the Kremlin’s premier source of wealth and power in retaliation for its intervention in Ukraine.

In announcing coordinated sanctions, American and European leaders went beyond previous moves against banking and defense industries in an effort to curtail Russia’s access to Western technology as it seeks to tap new Arctic, deep sea and shale oil reserves. The goal was not to inhibit current oil production but to cloud Russia’s energy future.

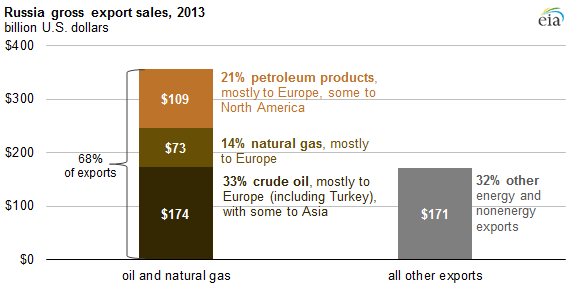

The new strategy took direct aim at the economic foundation of Russia, which holds the largest combined oil and gas reserves in the world.

Critics are saying that President Vladimir V. Putin overreached by suggesting that Russia could thrive without the West.As Sanctions Pile Up, Russians’ Alarm Grows Over Putin Tactics

How Much Europe Depends on Russian Energy?

The growth of the oil industry in the last two decades has powered Russia’s economic and geopolitical resurgence since the collapse of the Soviet Union and enriched allies of President Vladimir V. Putin. Russia pumps about 10.5 million barrels of oil a day, making it among the largest producers.

“The biggest edge that Western energy companies still have is their technological edge — that’s why these sanctions have the potential to have significant impact,” said Michael A. Levi, an energy expert at the Council on Foreign Relations. “Chinese companies can’t step in and provide shale technology where U.S. companies are blocked. They can provide capital; they can provide people. They can’t fill in on the technology front.”

The technology cutoff could be important because Russia is only now at the early stages of developing new Arctic, deep sea and shale resources. Most of its current production comes from depleted Siberian deposits that will eventually run out. And several Western oil companies have been working with Russia to expand their resources.

ExxonMobil has a joint venture with Rosneft, the state-owned oil giant, to develop Arctic oil, and is scheduled to start drilling in the Kara Sea within weeks. BP, which owns 19.75 percent of Rosneft, just signed a joint venture with the Russian firm in May to search for shale oil in the Volga-Urals region.

Even though BP announced higher quarterly profits on Tuesday, its stock was hammered by the sanctions news, falling 3 percent. BP warned investors bluntly that further sanctions “could adversely impact our business and strategic objectives in Russia.”

Dan Yergin, chairman of Cambridge Energy Research Associates, said the new energy measures underscored how much ties had deteriorated. “A year ago, Western collaboration with Russia’s energy sector was one of the bright spots in what had become a dour relationship,” he said. “No longer.”

The growth of the oil industry has powered Russian economic and geopolitical resurgence since the collapse of the Soviet Union.

The carefully orchestrated actions on both sides of the Atlantic were intended to demonstrate solidarity in the face of what American and European officials say has been a stark escalation by Russia in the insurgency in eastern Ukraine. Until now, European leaders had resisted the broader sorts of actions they agreed to on Tuesday, and their decision to pursue them reflected increasing alarm that Russia was not only helping separatists in Ukraine but directly involving itself in the fighting.

They are “meant as a strong warning,” Herman Van Rompuy, the president of the European Council, said in a statement on Tuesday that was joined by José Manuel Barroso, the president of the European Commission. “Destabilizing Ukraine, or any other Eastern European neighboring state, will bring heavy costs,” the statement said.

President Obama said Russia’s economy would continue to suffer until it reversed course. “Today is a reminder that the United States means what it says, and we will rally the international community in standing up for the rights and freedom of people around the world,” he told reporters on the South Lawn of the White House.

Mr. Obama said the fact that Europe was now joining the United States in broader measures meant the moves would “have an even bigger bite,” but in response to reporters’ questions, he said it was “not a new Cold War” between the two countries. He also made clear he was not considering providing arms to Ukraine’s government, as some Republicans have suggested, as it tries to put down the pro-Russian insurgency.

“They are better armed than the separatists,” he said. “The issue is, ‘How do we prevent bloodshed in eastern Ukraine?’ We’re trying to avoid that. And the main tool that we have to influence Russian behavior at this point is the impact that it’s having on its economy.”

The US president, speaking from the South Lawn of the White House, discussed new economic sanctions against Russia amid unrest in neighboring Ukraine. Publish Date July 29, 2014.

The American and European actions were intended to largely, though not precisely, match each other. The United States cut off three more Russian banks, including the giant VTB Bank, from medium- and long-term capital markets and barred Americans from doing business with the United Shipbuilding Corporation, a large state-owned firm created by Mr. Putin. The Obama administration also formally suspended export credit and development finance to Russia.

The European Union adopted similar restrictions on capital markets and applied them to Russian state-owned banks. It imposed an embargo on new arms sales to Russia and limited sales of equipment with both civilian and military uses to Russian military buyers. Europe also approved new sanctions against at least three close Putin associates, but did not identify them publicly.

European governments moved ahead despite concerns that Europe would pay an economic price for confronting the Kremlin more aggressively. While their actions went far beyond any previously taken against Russia over the Ukraine crisis, they were tailored to minimize their own costs. The arms embargo, for instance, applies only to future sales, not to the much-debated delivery by France of Mistral-class helicopter carriers that resemble bigger aircraft carriers. And the energy technology restrictions do not apply to Russian natural gas, on which Europe relies heavily.

The new sanctions could take effect as soon as Friday, though the necessary legal formalities would most likely to take longer to complete, officials said.

On Twitter, the president of Lithuania, Dalia Grybauskaite, praised the decision “on a wide range of sanctions on Russia.” But she expressed unease that France would be able to maintain its naval deal with Moscow. “Unfortunately, nothing to stop the deal of Mistral yet,” she wrote. Lithuania is one of five European Union states that are close to or border Russia.

Lithuania's President Dalia Grybauskaite

Mr. Van Rompuy departed from the usual cautious language of Europe’s declarations by condemning Russia for actions that “cannot be accepted in 21st-century Europe,” including “illegal annexation of territory” — a reference to Crimea — “and deliberate destabilization of a neighboring sovereign country.” He also cited the “anger and frustration” over the downing of Malaysia Airlines Flight 17 over rebel-held territory on July 17 and “the delays in providing international access to the site of the air crash, the tampering with the remains of the plane, and the disrespectful handling of the deceased.”

EU President Herman Van Rompuy

Although European commerce with Russia will probably decline because of the sanctions, where the measures are expected to more severely affect Russia are the restrictions on the ability of Russian banks to raise money in Europe and the United States. “These sanctions can have quite a substantial chilling effect on the Russian economy,” said Adam Slater, a senior economist at Oxford Economics in London. “That is probably a quite effective way to put pressure on Russia.”

Still, it could take time for the effects to be felt by ordinary Russians, and some analysts expected the Kremlin to shrug them off, at least publicly.

--------------------------------------

Peter Baker reported from Washington, Alan Cowell from London and James Kanter from Brussels. Jack Ewing contributed reporting from Frankfurtt.

Some related and informative articles published some 3 month ago:

No comments:

Post a Comment